By Matthew R. Staul, EA, MBA

It is important to understand how your long-term capital gains are being taxed to be sure you have made the correct estimated tax payments before your tax return is filed. There is nothing worse than being blindsided by a large balance because of misunderstood capital gain tax rates. It is essential to be in close contact with your financial advisor throughout the year to be sure you and your advisor are on the same page as far as the gains are concerned.

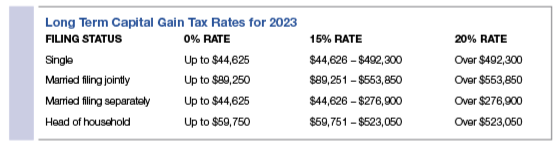

The chart below reflects the current tax rates through President Trump’s Tax Cuts and Jobs Act. The current law is set to expire in 2026, and there is a possibility of a major change. President Biden has proposed a shift to a 37% long-term capital gains tax rate for married filing joint taxpayers who have taxable income over $1 million, and $500,000 for single and married filing separate taxpayers. There is also a proposal to tax unrealized gains at the time of death or gift. Currently, under the circumstance of receiving inherited property or stocks after death, you can use the stepped-up basis to determine your current value of the asset. The new proposal would tax the inherited assets at the assessed value at the time of death. This would significantly increase the tax liability of the taxpayer who receives the inherited asset.

How to Offset Capital Gains

• Use capital losses to your advantage. If there is a situation in a bull market year where the gains are higher than usual, make sure you talk to your financial advisor about selling off stocks that have not performed well over the years. This will help reduce the total liability when your tax return is filed. If the losses outweigh your total capital gain, you can take a loss up to $3,000 at the end of the year.

• Use your tax-advantageous retirement plans to trade stocks. You will not have to pay capital gains tax on any gains that are in a qualified retirement plan. The withdrawals from these accounts once you reach the qualifying age will only be taxed as ordinary income no matter how well the stocks performed over the years.

Matthew R. Staul is an enrolled agent with the Medical Management Consulting Group, Inc., a full-service consulting and accounting firm based in Virginia Beach. mmcgonline.com